“The old rule of forecasting was to make as many forecasts as possible and publicize the ones you got right. The new rule is to forecast so far in the future, no one will know you got it wrong.” — Ruchir Sharma, investor

Speaking to Congress in late October, Pemex CEO Octavio Romero Oropeza seemed pretty confident when he promised that the state owned oil company would boost oil production to 1.9m barrels per day (bpd), almost 200,000 bpd more than the September average, the latest available figure.

The company lowered its projections from 2019 when it had predicted a reversal of the 15-year downward trend and an increase to 2m bpd by late 2020. So Romero Oropeza isn’t the first CEO to fall short of production forecasts. But he does come off as more optimistic than his predecessors that hecan turn around the numbers of a company that cranked out 3.4m bdp in 2004, a little more than half of the most recent levels.

What has Romero done differently from his predecessors?

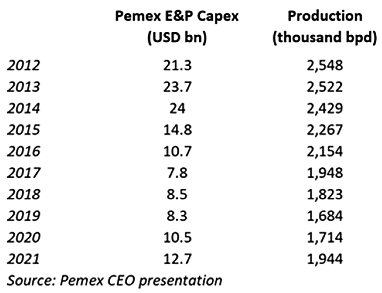

He has said that the company’s budget is bigger than it was under the last administration thanks to the current administration, headed by President Andres Manuel Lopez Obrador (AMLO), which is true. But capex for exploration and production in 2019 and 2020 is still lower than the annual budgets for 2008 through 2014, a timeframe when the company allocated USD 18bn to USD 24bn to those activities.

Romero doesn’t have to face competition the way his last three predecessors did. That’s because oil auctions have been canceled for the foreseeable future. This puts Romero in the position that previous Pemex CEOs enjoyed for 70 years.

Another change under Romero is in how Pemex accounts for its production, said an industry source. The company now takes oil condensates into account, expessing such figures under “liquids” instead of just “oil” barrels.

Oil condensates started to appear in the stats in 2016 with an average of 6,800 bpd, but now they’re at 51,200 barrels, according to data from the National Hydrocarbon Commission (CNH). Condensates are not equal in value to oil barrels — that is why prior administrations did not take them into account, said the industry source.

Perhaps the most important shift has been Romero’s decision to shut down exploration in deep waters and unconventional onshore fields to focus on shallow waters and conventional onshorefields, which executives under prior administrations were afraid might soon be depleted. Current management, though, is only too happy to double down in the areas that are its traditional strength.

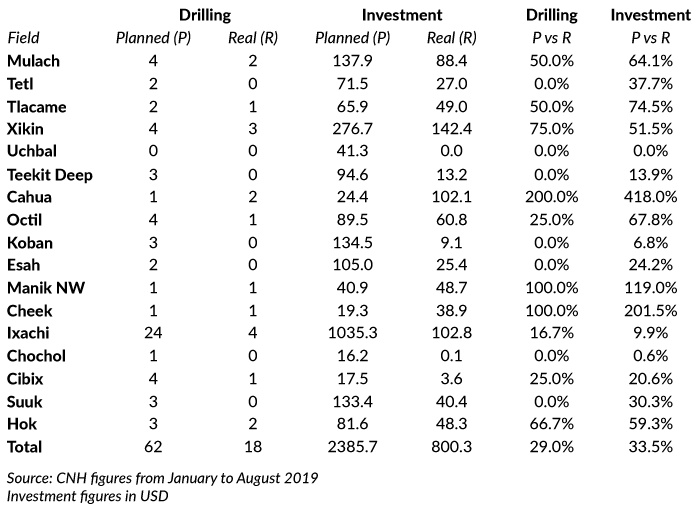

That is why Romero has eagerly pointed to a group of 20 fields where the company is placing all its bets, as being the showcase of his administration’s success.

How is Pemex doing with these “champion” fields?

Romero said the company already produced around 139,000 bpd from those fields in October. Not bad. But Pemex had expected that by this date it would be closer to producing 200,000 bpd from this field, with 300,000 bpd on the horizon for next year.

Regulator CNH has also said Pemex is behind its own forecast by 71% in the number of wells drilled and 66.5% in capex allocated to this area.

Can Pemex get where it wants to be?

The company may try to reach its forecast of 2.24m bpd in 2024, the final year of AMLO’s administration. Pemex’s first forecast in 2019 was to produce 2.4-2.6m bpd by that year, but Romero is still rather far from getting there. And that’s because of one overriding reason: insufficient budget.

Some of that issue is manifested in debt.

“Pemex’s earnings results tell us that the company is still dragged down by its burden of loan debt and debt with suppliers,” said Layla Vargas, CEO at consultancy Muvoil.

She added that some suppliers are halting work on contracts because of delayed payments. The solution is to seek farm-outs, which could provide Pemex with the capex it needs, said Vargas and the industry source.

But neither AMLO nor Pemex have shown any interest in going this route. And even if they did, they might have trouble finding partners with the administration being so bent on increasing the company’s monopolistic power.

Romero seems sure of himself when it comes to his ability to deliver results. Still, there are plenty of people in the industry who aren’t convinced.

by Edgar Sigler

Source:

REDD LATAM