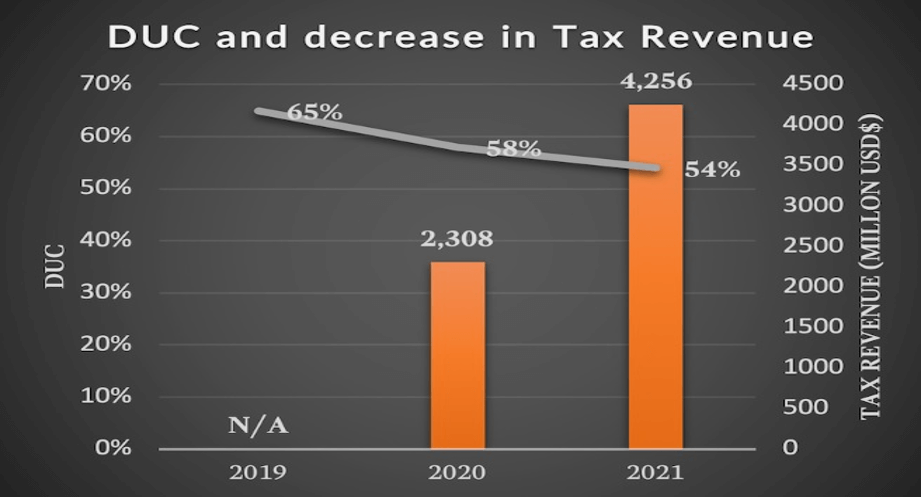

On December 9th, 2019, the Official Gazette published the “Decree that reforms and adds various provisions of the Hydrocarbons Revenue Law” (the Decree) which aim is to reduce Pemex’s shared utility right (DUC[1], by its Spanish acronym) from the current 65% to 58% in 2020, and 54% by 2021.

The legal amendment is part of the strategy of strengthening the State Productive Enterprises (SPE), announced since the beginning of this year in the National Development Plan and Business Plan for PEMEX and its subsidiary companies 2019-2023 (Pemex’s Business Plan). Said strategy consists, among other measures, in:

- Refinancing of bank revolving credit lines for 8 B US dollars (USD).

- Prepayment of debt with maturity between 2021 and 2023, equivalent to 5.006 BUSD, through capital contributed by the Federal Government.

- Refinancing and issuance of new bonds for 7.5 BUSD, the largest made by any Mexican issuer in the history of Mexico.

- Exchange of bonuses with close maturity for bonds with longer maturity, for an amount of 7.623 BUSD.

- Drilling 47 exploratory wells with an investment of 10 BUSD, which represents doubling the investment in shallow waters and onshore.

- Developing 20 fields per year from 2019 to 2024.

The reduction of the DUC also pursues to balance the conditions of Asignaciones with the current E&P Contracts, which are perceived much more convenient for Operators by having more favorable fiscal conditions. As an example, the Production Sharing Contract for Ek Balam[2], the only migration of an Asignación to an E&P Contract without a partner, establishes an Operating Profit[3] of 70.5% – higher than the DUC -, but allows deductions of 60% compared to the 12.5% allowed for Asignaciones[4].

This reduction may allow Pemex to incorporate to its portfolio projects previously considered unprofitable. Former administrations had proposed tax benefits for mature and marginal fields, as well as deep water projects[5], which technological challenges made their development more expensive.

Despite the measures mentioned herein, the present administration has focus Pemex activities in mature and marginal projects, while there are possibilities for its investment portfolio, such as associations, that had been a success to develop more complex and expensive projects.

With this amendment, the Federal Government seeks to release resources for PEMEX and to attack the drop-in hydrocarbon production, income reduction, investment decline and accelerated debt growth.

[1] DUC is an annual payment equivalent to Pemex’s share with the State of the total produced hydrocarbons – including self-consumption and waste – less the deductible items. Deductible items are: i) 100% of exploratory investments, EOR and non-capitalizable maintenance; ii) 25% of the original amount of investments for development and extraction for oil and gas projects; iii) 10% of the investment for storage and transport infrastructure; iv) costs and expenses related to the extraction of oil and gas, and v) the Right for Hydrocarbons Extraction, according to the a. 44 of the Hydrocarbons Revenue Law.

[2] Pemex is a contractor of other three E&P Contracts, awarded through bidding processes, however, that scheme has not been considered so far to grant new contracts. For further details about the Ek-Balam Contract please click on the following link: https://rondasmexico.gob.mx/esp/contratos/cnh-m1-ek-balam2017/?tab=02

[3] Operating Profit is calculated as the Contractual Value of Hydrocarbons plus Additional Incomes – as services provided to other contractors and sale and disposal of sub products – less Cost Recovery and Royalties already paid to the State.

[4] Article 41 of the Revenues Hydrocarbons Revenue Law.

[5] Article 41 of the LISH proposes a 60% cost deduction for the oil extracted from the Chicontepec region and deep water projects. Similarly, the 2008 Energy Reform proposed a modification to the Pemex tax regime, that included among its measures the reduction of the Extraordinary Right on Petroleum Extraction for fields in Chicontepec and deep waters.

By Génesis García / Rosalía Hernández, Consultants at Muvoil Consulting

genesis.garcia@muvoil.com / rosalia.hernandez@muvoil.com

Muvoil Consulting is a group of specialists in the O&G sector: legal, fiscal, social and environmental. Our multidisciplinary approach allows us to design strategic solutions that can unravel the most complex regulatory and transactional challenges that a petroleum project can face. Do not hesitate to contact us for further details.